Budget 2020 Highlights : PDF Download, Key Takeaways, Important Points.Section 80G – Donations Eligible Under Section 80G and 80GGA – 80G Exemption List.Budget 2022 Highlights : PDF Download, Key Takeaways, Important Points.

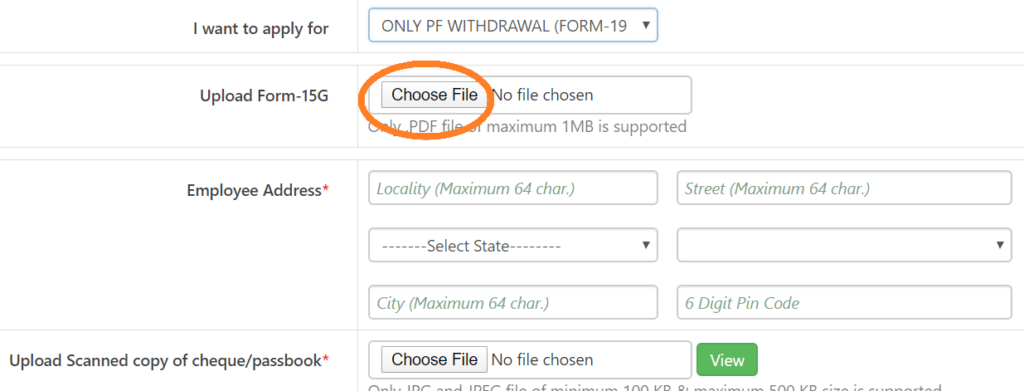

Estimated Income for which this declaration is made – Enter the amount for which withdrawal is made(Only PF Amount, Pension Amount Not Included). Whether accessed to tax under the Income Tax Act, 1961– Tick Yes if you have taxable income in any of the previous 6 financial years also mention the Assessment Year where the income was taxable(AY 2022-23), otherwise Tick Noġ6.

Telephone No – Mobile Number or Landline Number with STD Codeġ5. Email Address – Email address for communication purposesġ4. Why Form 15G is Required For PF Withdrawal?ġ3. Form15G is used for individuals whose age is below 60 years and Form 15H is required for senior citizens i.e the individual who is over 60 years of age.

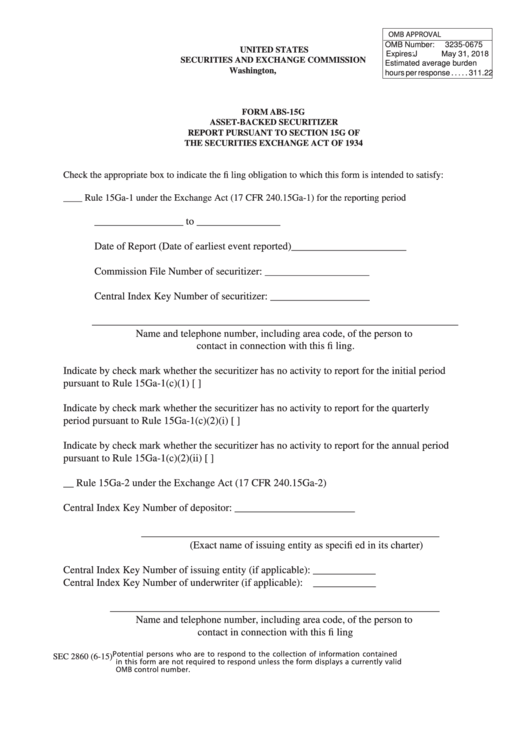

Guide to Fill Form 15G for PF Withdrawal, Form 15G PDF Download & Sample 15G Form To avoid TDS during Provident Fund Withdrawal What are Form 15G and Form 15H?įorm 15G and 15H are the two self-declaration forms that are used by an individual to request banks or other financial institutions to not deduct TDS from the interest income as their income is not taxable or below the exemption limit. 1.10 What happens when Form 15G is not submitted?.1.9 What is the difference between 15G and 15H Forms?.1.7 Is Form 15G Mandatory for PF Withdrawal?.1.2 Why Form 15G is Required For PF Withdrawal?.1 Guide to Fill Form 15G for PF Withdrawal, Form 15G PDF Download & Sample 15G Form To avoid TDS during Provident Fund Withdrawal.

0 kommentar(er)

0 kommentar(er)